Q4 Earnings Season Kicks Off with Mixed Results as Tech Giants Report

The Q4 earnings season has begun, with mixed results from tech giants like Tesla, Microsoft, and Meta. Here’s a breakdown of key highlights.

Tesla Misses Expectations but Shares Rise

Tesla missed Q4 earnings and revenue targets. Despite this, shares rose 8% by week’s end. Investors remain optimistic due to Elon Musk’s ties to President Trump.

Microsoft Beats Estimates but Shares Drop

Microsoft exceeded Q4 earnings and revenue expectations. However, light revenue guidance caused shares to fall over 9% in the next trading session.

Meta Impresses with 21% Revenue Growth

Meta reported a 21% increase in Q4 revenue. The company’s AI investments are paying off, with plans to invest $60-$65 billion in 2025.

Apple Sees Growth in Services Segment

Apple’s Q4 revenue grew 4% year-over-year, driven by its Services segment. iPhone sales slowed in China, but shares rose 3% post-report.

Nvidia Faces Challenges from DeepSeek

Nvidia shares tumbled 17% after Chinese AI firm DeepSeek released a cheaper ChatGPT-like tool. This marked Nvidia’s largest one-day loss since March 2020.

Overall Earnings Growth Strong

Q4 earnings growth is at 13.2%, the best in three years. Revenue growth trails at 5%, according to FactSet.

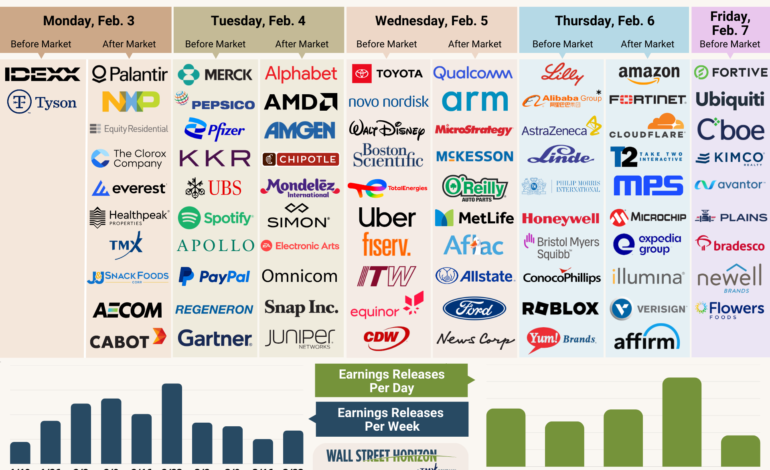

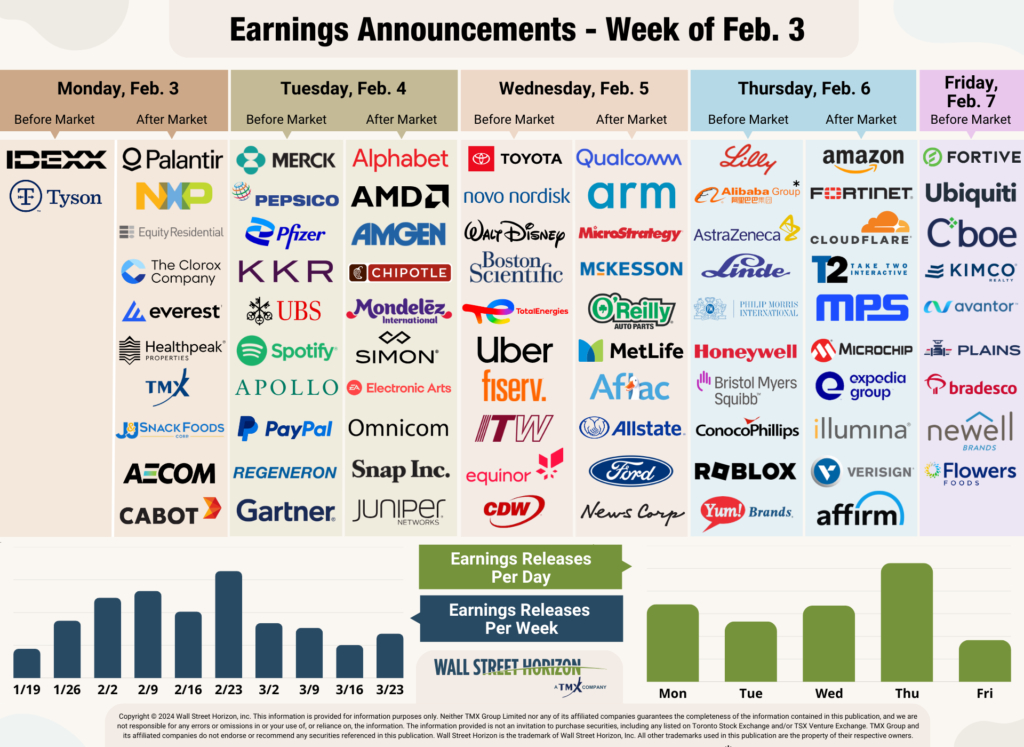

Upcoming Earnings Reports

Alphabet reports on Tuesday, and Amazon on Thursday. Both are expected to provide further insights into the tech sector’s performance.

Outlier Earnings Dates

Seventeen S&P 500 companies confirmed outlier earnings dates this week. Thirteen have negative DateBreaks Factors, signaling potential bad news.

Advanced Micro Devices (AMD)

AMD reports Q4 earnings on February 4, a week later than usual. The delay follows a downgrade by Melius Research due to competition concerns.

Juniper Networks

Juniper Networks also reports on February 4, a week later than expected. The delay may relate to its $14 billion acquisition bid by Hewlett-Packard, now blocked by the DOJ.

Conclusion

The Q4 earnings season shows mixed results but overall better-than-expected performance. Investors should watch upcoming reports for further market insights.

Stay updated on earnings season trends to make informed investment decisions.